Open banking offers a fast, secure, and future-proof way to take and make payments online, allowing merchants and businesses an alternative way to accept payments, without having to rely on card networks.

Adoption of this innovative financial technology solution is accelerating rapidly in the UK and starting to take off across Europe too, with millions of payments being made by Open banking every month, helping businesses to improve their customer experience and cut costs.

What Is Open Banking?

Open banking is the term used to describe financial technology and practice which allows access and a degree of control over consumer and business bank accounts via third-party applications connecting through an API.

Open banking is making waves in the financial world and quickly being adopted by businesses looking for seamless payment solutions which help reduce cost, decrease risk, and offer an improved user experience.

How Does Open Banking Work?

Under new PSD2 regulations, banks and financial institutions are required to provide an API to enable regulated third parties to connect to the bank’s platform in a highly secure way, to access a customer’s financial details and make payments.

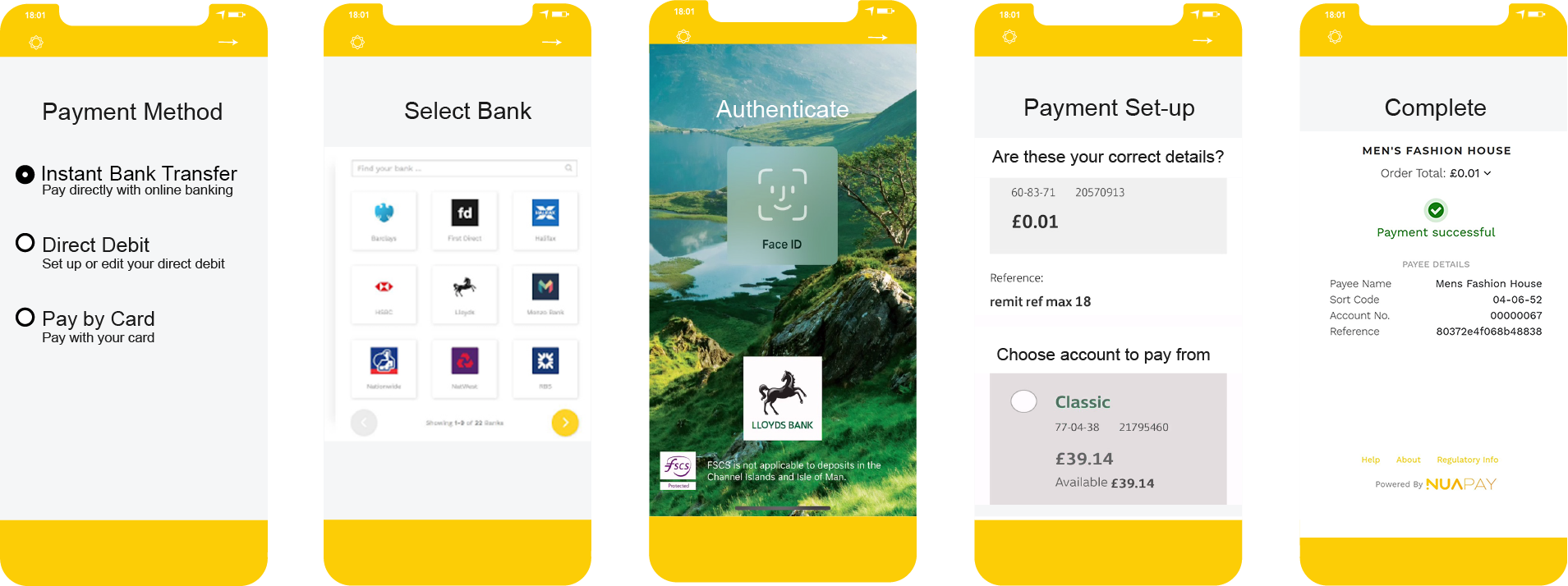

Via the API, third parties can enable a customer to connect securely to their underlying bank to send a payment, all in a seamless way from the third party’s app or website. This enables customers to pay via a bank transfer in a fast and secure way, with the funds then sent in real-time from their bank account, and straight to the merchant.

Payment can be set up in just a few clicks, and the simple interface makes open banking APIs easy to use and highly accessible.

What are the Benefits of Open Banking for my Business?

Utilising open banking opens up a range of benefits to help your business run efficiently and help maximise growth.

Some of the key benefits include:

Payments in real-time – Improve cash flow by receiving payments instantly

Reduce business risk – Open banking offers a highly secure, SCA compliant payment solution

Reduce cost – Open banking offers payment solutions for a low-cost fee, and with Nuapay, there are no charges on failed or declined transactions, and no hidden fees

Payment Type Flexibility – Open banking can be tailored to suit your business needs, whether you need one-off, regular, instalments or subscription payments

Actionable Real-Time Reporting – API access to all your accounts and services, with real-time reporting and fully automated reconciliations

What are the Benefits of Open Banking for my Customers?

Open banking offers an attractive solution to consumers, from the peace of mind delivered by stringent security, to the convenience of a payment solution which can be used in minutes, wherever they are.

Some of the key benefits include:

Quick & Simple Payment Process – Open banking provides the most efficient way for users to make payments on their mobile device

Peace of Mind – Consumers retain full control over their payments, only authorising specific payments and amounts

Security – Using an open banking API, users do not enter pass any card details or credentials to the merchant, reducing fraud and helping keep their banking details safe

Compliance – Open banking solutions comply with PCI standards, as customers must give explicit consent to share data

One-Stop Solution – With open banking, users can pay a wide variety of businesses with one just mobile app, while seamlessly receiving refunds back in real-time if needed, or setting up recurring payment plans

You can find out more about the benefits of open banking in our What Are the Benefits of Open Banking? article.

Examples of Open Banking

Open banking for Financial Services

Open banking payments offer a great alternative in the financial services sector for customers to pay off credit cards, top up prepaid cards, make a forex transaction, or load an investment or savings account.

Particularly for financial services businesses that are digital first and engage customers to make payments via their App or website, Open banking can offer a seamless, App to App payment experience for their customers, ensuring greater control of the end to end customer journey.

Payments in this sector typically have higher transaction values and, as such, have very high fees and charges where customers make these payments via their debit card. In addition, funds typically don’t settle until at least the next day, and businesses also need to worry about chargebacks or fraudulent payments.

Open banking can not only deliver faster speed of pay and reduce risk for the merchant on payments, but it can also ensure that the customer’s account can be topped up immediately, without any risk to the merchant, delivering a better customer experience.

Open banking for the Insurance Industry

For services such as insurance, an efficient and risk-free payment environment is essential.

Not only can Open banking payments deliver faster speed of pay and reduce risk for the merchant on individual payments to establish a policy, but with Nuapay, customers can also seamlessly set up recurring payment schedules by integrating Open banking and Direct debits.

Nuapay’s new Open banking e-mandate solutions for Direct debits are a market leading innovation, which validates a payer’s direct debit account details using Open banking and Strong Customer Authentication (SCA). This means the merchant can be sure the account details are correct, are owned by the payer, and have sufficient funds for the first transaction.

This leads to a much lower risk recurring solution, particularly when coupled with Nuapay’s Direct Debit solutions which are considered one of the most advanced on the market, and proven at improving efficiency and cutting failed collections for our clients by up to 40%.

You can find out more about the benefits of Nuapay’s direct debit solutions for insurance services here.

How Do I Get Started with Open Banking?

Speak to our experts about how open banking can help you offer secure, efficient payment solutions to your clients, for a low fee and complete peace of mind.

Nuapay is the industry’s leading provider of Account-2-Account payment solutions. Building upon the trust, scale, and experience of our parent company Sentenial – who securely process over €42bn every year as an outsourcing provider to many of the world’s leading banks – we work tirelessly to reinvent what’s possible from open banking.

Today, we offer partners all around Europe the world a fully comprehensive, integrated payment solution that removes all traditional banking inefficiencies and unnecessary costs, saving you time, money and resources at every turn. This is payments as they should be.